Budget Variances

Budgeting is the engine-room of your business and without one, the business will not move, or survive.

A budget is the foundational framework for business finances, using past performances and providing a tool for forecasting for the financial year.

Budgets enable a business to set goals, priorities, spending caps, and details where funding originates and where new strategies might create revenue.

Budget Preparation

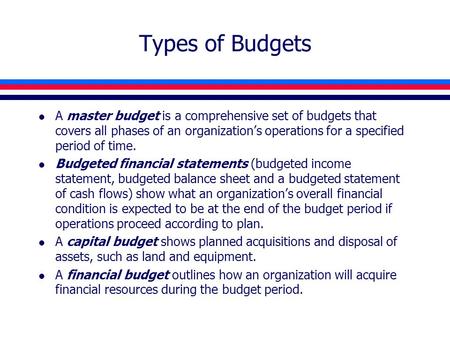

An effective budget should break down revenue and anticipated expenses by month or by quarter, and depending on the size of the business, it should include separate budgets for each department. These departmental budgets should also be broken down by month or by quarter, and collectively they will come together to form the master budget.

Budget Monitoring

Budgets are necessary for evaluating the performance of a company, over the course of each financial year by tracking actual revenue and expenses and comparing them to the budget. This helps to assure that the business is following its plans and offers an important means of identifying problems and opportunities.

Budget Reporting

Monthly budget reports should be prepared at the end of each month which informs

management of any anomalies that have occurred. The budget may also have to be reviewed and changed.

Budget Conservatism

Sales and expenses are to be set on a realistic basis after all factors are taken into consideration:

-

Competition

-

Marketing

-

New products

-

Increase in staffing levels

-

Weather

-

CPI

-

A.T.O. changes

-

Government policy changes

-

Major events

-

Change in R.O.I. expectations

Start-Up Budgeting

Starting a budget from scratch can be daunting. How do you estimate your sales and expenses?

Traditional budgeting carries over the previous years’ allocation but with Start-Ups this information is not available. This is where the Zero-based budgeting (ZBB) method can be utilised.

Zero-based budgeting (ZBB) is an approach in which brand-new budgets are always calculated from a zero base, rather than estimating it based on past budgets.

Incremental Budgeting

Incremental budgeting is a type of a budgeting process that is based on the idea that a new budget can best be developed by making only some marginal changes to the current budget. In other words, with incremental budgeting, the current budget is used as a base to which incremental assumptions are added or subtracted from the base amounts to determine new budget amounts. Among all budgeting methods, incremental budgeting is commonly considered as the most conservative approach.

Are you familiar with Accounting Ratios?

| Jan-21 | ||||||

| Budget | Actual | Variance | ||||

| Sales | $21,215.30 | 100.00% | $21,000.00 | 100.00% | ($215.30) | -1.01% |

| COGS | $3,032.61 | 14.29% | $2,900.00 | 13.81% | $132.61 | 4.37% |

| Gross Profit | $18,182.69 | 85.71% | $18,100.00 | 86.19% | ($82.69) | -0.45% |

| Cash Flow Statements | |||

| Month | Jan-21 | Feb-21 | Mar-21 |

| Operating Expenses | |||

| Inflow | |||

| Sales | $23,336.83 | $23,336.83 | $22,584.03 |

| Total Inflow | $23,336.83 | $23,336.83 | $22,584.03 |

| Outflow | |||

| Purchases | $3,335.87 | $3,335.87 | $3,228.26 |

| Wages | $2,996.28 | $2,996.28 | $2,899.63 |

| Wages Burden | $344.57 | $344.57 | $333.46 |

| Repairs & Maintenance | $133.54 | $133.54 | $129.23 |